Owning your own home – a space where you can express yourself, welcome loved ones, and create lasting memories – is a dream for many people. But the reality is that buying a home is becoming more and more of a challenge.

The biggest roadblocks that stand in the way for prospective home buyers are mounting debts, sky-high rent, and wages that aren’t keeping up with the cost of living.

While this journey has its obstacles, it’s important to remember that this also reflects a dynamic market. If you are willing to make small concessions, be patient in saving, and consistently pay off your outstanding debts, you can still uncover many homeowning opportunities.

It’s hard not to feel discouraged, but that’s where we come in. We’ll guide you along the way and get you started on a savings plan that is strategic, sustainable, and most of all, sensible.

Ready to get started? Follow these steps to construct your first home savings plan blueprint.

Pay off any existing debts

Before taking on a new debt as substantial as a mortgage, shift your focus to any outstanding debts you are currently paying off. This could include:

![]() Credit Card Balances

Credit Card Balances

![]() Student Loans

Student Loans

![]() Car Loans

Car Loans

![]() Lines of Credit

Lines of Credit

Paying these debts off has a great impact on saving for a home because it will help boost your credit score. But how do you know which of these debts you should target first?

These types of loans may carry high interest rates and charges that can start adding up over time, which can take away from your goal of saving towards your down payment each month. One survey found more than 80% of people with student debt felt it impacted whether they could purchase a home. Your financial advisor will be able to assess your situation and explain which strategy will work best and may suggest one of the following:

Debt Avalanche Method

One aggressive repayment strategy is the debt avalanche method where you pay the monthly minimum on all your debt, but really focus on paying off the loan with the highest interest rate first. Once you have paid this off, focus on the next highest until you’ve paid all your loans. This helps eliminate the number of payments you need to make each month, so there are fewer opportunities to make late payments, which impacts your credit score.

Debt Consolidation

Also, you could consider debt consolidation if you have a low interest line of credit available. Here, you combine several debts into one loan, so you’re only making one payment a month, saving interest costs.

Keeping your debt balance under 30% of your available credit has a positive impact on your overall credit score. As long as you are making minimum payments on time each month, you can maintain a balance and improve your credit score.

Explore savings plans for first-time home buyers

Now that you have a plan for strategically repaying your debt, how about a strategic plan for saving? Every great journey starts with a single step, and the first step in your strategic saving is opening an account. Want to know something great? There are savings plans designed specifically for first-time home buyers in mind that will help you grow your money faster and allow you to withdraw those savings without tax penalties.

Tax-Free Savings Account (TFSA)

With the guidance of your advisor, explore options for down payment savings in your Tax-Free Savings Account. The TFSA can hold anything from cash to investments like mutual funds, stocks or bonds and you can withdraw your money tax-free whenever you’re ready. Keep contribution limits in mind — each year, individuals are allowed to contribute a set amount to their TFSA ($7,000 in 2024, for example), although you can also take advantage of unused contribution room from previous years.

First Home Savings Account (FHSA)

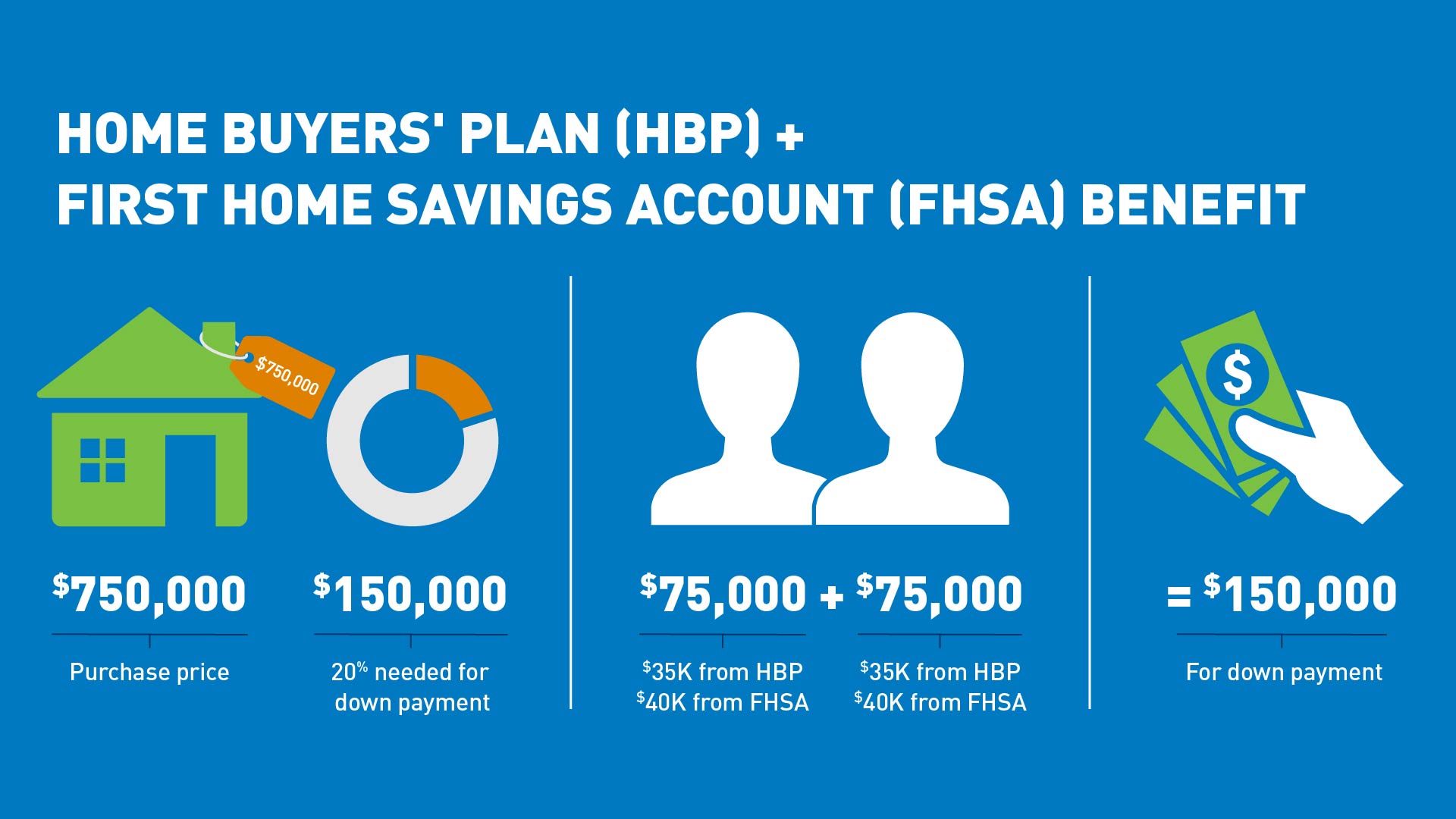

The new First Home Savings Account is a registered plan where first-time home buyers can contribute up to $8,000 a year, up to a lifetime maximum of $40,000 to save for their first home. Then, you not only withdraw this amount tax-free when you buy your property, but you’ll also get a tax deduction each year you contribute to your FHSA!

Home Buyers Plan (HBP)

You can also take advantage of your RRSP through the Home Buyers’ Plan, which allows you to withdraw up to $35,000 from your RRSP for your first home. You then repay it to your plan over 15 years. Also, you get a two-year grace period before you start paying it back. The Canadian Government introduced new increased contribution limits in its 2024 budget, which are currently pending.

Focus on your down payment

No home buying saving plan is complete without the goal in mind: the down payment. The standard for a long time has been 20%, but recent changes in home prices have driven more and more people to lower entry into the market.

Homes in BC require a down payment of at least 5% of the first $500,000 of the purchase price, and 10% of any amount over that, up to $999,999. For homes over $1 million, the required down payment is 20%.

Putting less than 20% down on a home

20% has traditionally been the standard for down payments, but there are many reasons people decide to put less down even if they’re able to pay a higher down payment.

A lower down payment might mean more money in your savings, which is never a bad thing. Plus, if you’re investing in a first home that is, frankly, a fixer-upper, you may need some cash available to do repairs, renovations, and even just buy new appliances or furniture.

But, for all down payments under 20% you’ll also be required to have mortgage loan insurance, called mortgage default insurance. This insurance protects your lender in the event you can’t make your mortgage payments. This cost is then reflected in your mortgage payments.

Crunching the numbers

Don’t forget that, depending on the home’s value, you are required to have a minimum down payment.

Putting 20% down on a home

Putting more money down has benefits for a home buyer. Your monthly mortgage payments and overall balance will be lower, and you won’t have to pay the mortgage default insurance premium. Not just that, but you will also pay less interest over the life of your mortgage.

With that said, for many Canadians in many different areas, putting 20% or more down on a property simply isn’t realistic in many situations. The decision to buy a home needs to consider the whole financial picture in a holistic way; lower mortgage payments don’t matter when you can only afford your mortgage and nothing else.

Deciding how much you want to save toward your home is something to discuss with your advisor, but for you to ultimately decide.

Consider Your Other Costs

Saving for a down payment of upwards of $50,000 is a significant achievement! But it’s also just one part of all the costs of buying a home.

Preparing and saving means factoring in closing costs:

- Legal fees

- Home inspections and appraisals

- Moving costs

- Property transfer tax

Starting on April 1, 2024, first-time homebuyers in BC are exempt from the property transfer tax if they meet certain conditions.

(e.g. the property has to be their principal residence and its fair market value must be $835,000 or less.)

While your mortgage application takes your debt and other housing expenses into account when calculating how much you can afford, there are other costs that aren’t considered. Take your other costs of living into account like recurring bills, subscriptions, car expenses and childcare costs, into account.

Emergencies rarely happen at convenient times, so be sure to put money aside for things like home repairs.

Seek help when you need it

If you’re anxious to get into the real estate market, saving your down payment amount can feel like an endless process. This has guided many people to seek other sources for their down savings.

In one 2023 survey, upwards of 40% of first-time homebuyers in BC said they received a lump sum payment from their parents or relatives to help with the purchase of a home. Whether they contribute directly to your savings vehicles or help you in other ways so you can save more, your support circle can play an essential role in helping you become a homeowner.

By creating a customized first home savings blueprint with the help of your advisor that prioritizes getting rid of your debt and focuses on strategic savings — you’ll be building a successful path to purchasing your first home in BC with confidence!

Start your homeowner plan with Valley First

Your home will likely be the biggest purchase of your life, so make it a thought-out decision with the help of a financial advisor. We know the process, because many of us have been there ourselves, and now we want to guide you along the way.

Book an appointment with an advisor to talk about buying your first home.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. You are solely responsible for confirming that your FHSA, TFSA and RRSP contributions are within your allowable limits set by Canada Revenue Agency (CRA). All rules and contribution limits for FHSAs, TFSAs and RRSPs are set out by CRA, and applicable legislation apply. Information about FHSAs, TFSAs and RRSPs is based on what is currently available from the Canadian government and may be subject to change.