REFERRAL PERKS®

Earn $100* for you and your friend for every successful referral.

Learn how an FHSA helps you save for a mortgage faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

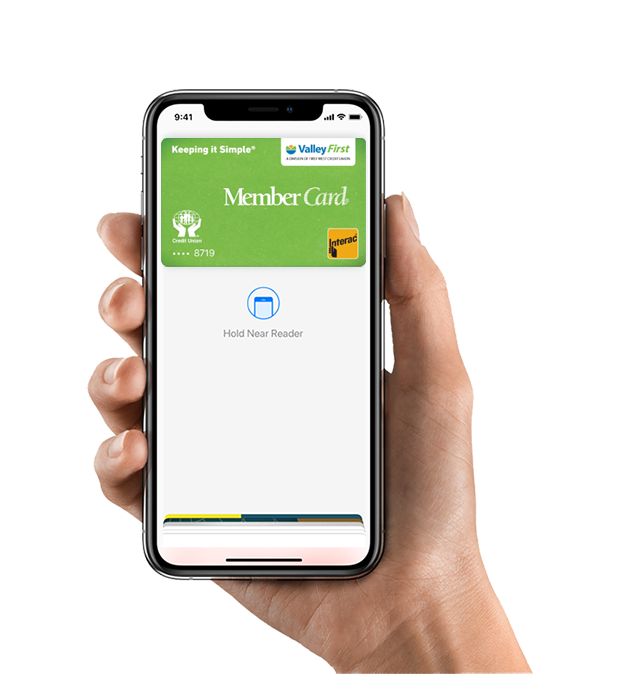

Using Apple Pay with your iPhone or Apple Watch is faster and safer than using a physical credit or debit card. Because spending money shouldn't mean spending more time at the register.

You can make secure purchases in stores, in apps and on the web. Add your Valley First credit or debit card to the Wallet app and go.

When you make a purchase, Apple Pay uses a device-specific number and unique transaction code. So your card number is never stored on your device or on Apple servers, and when you pay your card numbers are never shared by Apple with merchants.

![]()

![]()

Am I eligible for Apple Pay?

If you have an Valley First Interac Flash® MemberCard debit card or a Valley First Mastercard® credit card and an eligible Apple device, then you can get Apple Pay! Apple Pay is available to retail members with online banking access.

Which iOS devices support Interac® Debit on Apple Pay?

Apple Pay is supported on the iPhone 6 or later, iPhone SE, Apple Watch Series 2 and any Apple Watch paired with iPhone 5 or later.

Are there other reasons why my phone would be excluded from Apple Pay?

iOS devices that have been jailbroken or otherwise tampered with are not eligible for use with Apple Pay. The device’s operating system must also be kept up to date.

Will my Android/Windows/Blackberry phone work with Apple Pay?

Apple Pay is currently only available on Apple devices.

Will I receive notification that my MemberCard has been added to Apple Pay?

Yes. If you add your card through the Apple Wallet you will be notified in your Valley First mobile banking app. If you add your card through the Valley First mobile banking app, you will receive a notification via email the following day that your card has been added.

Can I use my Apple Watch with Apple Pay?

Yes, you can add a card to your Apple Watch through the Apple Watch app. To pay, place the screen of your watch against the point-of-sale terminal and double-press the button underneath the Digital Crown.

Can I use my Valley First credit card with Apple Pay?

Yes! Valley First Mastercard credit cards support Apple Pay.

How many cards can I add to Apple Wallet on any device?

A maximum of eight cards can be added to Apple Wallet on each device, across all card types (Visa, Mastercard, Interac, etc.) and participating financial institutions (including banks).

How do I set up Apple Pay?

iPhone:

Apple Watch:

Soon, Interac® Debit on Apple Pay will be supported for In-App purchases – allowing you to make Apple Pay purchases seamlessly from websites and retailer apps using the iPad Pro, iPad Air 2, iPad mini 4, and iPad mini 3.

Which account should I use for Apple Pay?

If you are activating a MemberCard that you use today to make purchases using Interac® Debit, Apple Pay will use the same default account (chequing or savings) that you use for Interac Flash® purchases. You may select or change this account either online or by contacting your local branch.

How do I make my Valley First card my default card in Apple Pay?

The first card you add to Apple Pay will automatically be set as your default card. You can select Valley First as your default card in either of two ways:

What else do I need to do to set myself up?

You are required to verify your card to add it to Apple Pay. You will be presented options to verify your identity either via the Valley First mobile banking app, contact centre, or via one-time password delivered either via email or SMS.

Can I add a second account or card to Apple Pay?

Yes, you can have up to eight cards in Apple Pay on any individual device.

How many devices can I add my card to?

There is no maximum number of devices to which you can add your Valley First card for Apple Pay. However, you are responsible for verifying the validity of the Valley First card on that device, and for any charges made with the card to the account — unless there has been a fraud.

What are the Terms & Conditions of my Valley First card in Apple Pay?

Apple Pay is governed in accordance with the terms and conditions that you approved when adding a card to Apple Pay. These are available for view at any time within Apple Pay. Simply activate your MemberCard, press the small (i) button in the bottom right corner, and scroll down to find these Terms & Conditions. Terms & Conditions are also available on our website.

Is additional information being captured on me when I use Apple Pay?

Apple Pay does not collect any transaction information that can be tied back to you. If location services are turned on, the location of your device and the approximate date and time of the transaction may be sent anonymously to Apple. Apple doesn’t receive any information about the rewards transaction other than what’s displayed on the pass. View our full privacy policy on our website for more information.

Why am I being asked to call Valley First?

The Valley First card needs to be verified by Valley First to protect against fraud.

How do I use Apple Pay?

If you’re using an iPhone, hold it up to the payment terminal with your finger on the home button. You’ll see “Done” on the display, along with a subtle vibration and beep, letting you know your payment information was sent. The display will let you know when the payment is approved.

For Apple Watch, hold the watch screen to the payment terminal and double click the side button. A tap and a beep will confirm your payment.

Is there an easy way to pay with another card?

Yes, to pay with another card you can simply select that card or change your default card.

Is there a maximum dollar amount for a purchase?

No, there is no maximum value for Apple Pay transactions, since each purchase is verified within Apple Pay using Touch ID. You might not be able to use Apple Pay for purchases over $100 CAD, tap would not work above the standard limits set at the POS terminals.

Am I subject to a daily spending limit?

Valley First will continue to monitor your total spending limit across the payment services that access your account, including your MemberCard at retail locations, banking machines and now Apple Pay. Apple Pay purchases will be subject to this total limit, which helps protect you from unauthorized use or access to your account.

Is there a cost to using Apple Pay?

No. Apple Pay is included as part of your Valley First account. Each Apple Pay payment will count as an additional transaction, if you pay transaction fees for your account. Please contact Valley First anytime to discuss the right account for you.

How do I know when a purchase is complete?

If you’re using an iPhone, a vibration will confirm your payment information has been sent. For an Apple Watch, a tap and a beep with confirm your payment. Apple Pay transactions will show a tick mark with a “Done” message whether the transaction is successful or declined.

Does Apple Pay work internationally?

Apple Pay using your MemberCard works wherever Interac Flash® is accepted. At this point, Interac Flash® is only accepted in Canada.

Where can I pay with Apple Pay?

![]() You will know that a terminal is capable of reading NFC if it has the label to the right, which looks a bit like the Wifi symbol. To use your MemberCard on Apple Pay, the retailer’s device requires the correct software to accept Interac Flash®, and usually displays the Interac Flash® logo.

You will know that a terminal is capable of reading NFC if it has the label to the right, which looks a bit like the Wifi symbol. To use your MemberCard on Apple Pay, the retailer’s device requires the correct software to accept Interac Flash®, and usually displays the Interac Flash® logo.

Will I have to sign a receipt or enter a PIN when paying with Apple Pay?

No, Apple Pay purchases are approved using Touch ID.

How do I view recent Apple Pay transactions?

To view your most recent Apple Pay transactions, open the Wallet app and select the card you want to view the transactions for. You may see all your transactions in your Valley First mobile banking app or through online banking.

Will I get a notification on my phone for a declined transaction?

Yes, you will get notifications for both declined and successful transactions. This may show as a tick mark / 'done' message on your phone, even if the purchase was declined. Check your account records for your current balance and transaction status.

Why does the transaction history on my iPhone not include purchases made with my Watch?

Your phone displays transactions performed only with that device, since the virtual card number on your watch is different than the card number on your phone. This security feature helps us to manage situations when a device (either the watch or the phone) is lost, stolen or upgraded.

How do I stop using Apple Pay?

Having a card with Apple Pay does not prevent you from making purchases using the plastic card. You also always have the option remove to your card from the Wallet.

How do I remove a card from Apple Pay?

To remove a card from Apple Pay on an iPhone:

To remove a card from Apple Pay on an Apple Watch:

Will removing my card deactivate my plastic card?

No, removing your card from Apple Pay will have no effect on your plastic card.

Will the case on my phone interfere with making purchases?

Apple Pay transactions use technology within the phone to communicate with the POS terminal and complete the purchase. The Apple Pay signal is a magnetic field created by a small antenna and interacts with a similar antenna on the POS reader. Depending on the thickness and material of the phone’s case, there could be interference, resulting in inconsistent usage of Apple Pay.

By re-positioning the phone on the terminal, and waiting up to a few seconds for the devices to communicate with one another, you should be able to successfully complete a purchase. For some thicker phone cases, you may need to remove the phone’s case to complete a purchase.

The antenna (an inductor actually!) is powered by NFC technology, which is further explained in the section on technology below.

What should I do if Apple Pay is not working with the POS terminal?

Apple Pay should work at all retailers that accept Interac Flash®. Depending on the location of the signal from the phone and the case you are using, you may need to either remove your case or re-position your phone on the POS terminal. And because POS terminals may be slightly different themselves, you may find that this experience varies a bit from retailer to retailer. If you are having difficulties, ask your retailer if they accept Interac® Debit on Apple Pay.

Do I need network access to make a purchase?

No. Your phone (powered and unlocked) has everything you need to complete a purchase at a retailer, whether or not you have network access at that time.

As with card purchases, you may not complete a purchase if the retailer’s POS terminal is off-line or unavailable.

You will need network access to receive transaction notifications from Apple.

How do I process a refund?

If you need to return a purchase made with Apple Pay you can receive a refund to your account. Refunds are initiated by the Merchant at the POS terminal following the same process as a purchase within Apple Pay.

The key difference is that you may be asked to provide to the cashier the last four digits of your Device Account Number instead of the last few digits of your card number. To find the last four digits of your Device Account Number for your card, tap the (i) button on your card in the Apple Wallet to view the back of your card.

Successful refunds will be processed immediately to your account.

I’m having trouble with Apple Pay. Who do I contact?

If you are having any difficulty with Apple Pay, please contact your local branch and we will be happy to answer your questions.

…Download a new version of the Valley First mobile banking app?

Apple Pay should not be affected by updating your Valley First app.

…Upgrade my iOS?

Apple Pay should not be affected by updating your iOS.

…Change my SIM?

Apple Pay should not be affected when you change your SIM.

…Change my lock screen password?

Apple Pay should not be affected when you change your lock screen password.

…Lose my iOS device?

You should contact Valley First immediately if you lose your mobile phone, so that we may de-activate your MemberCard within Apple Pay. You can also suspend/delete your card through iCloud.

…Lose my iOS device, and then find it?

Any suspended cards can be resumed but deleted cards cannot. You will be required to enter your card details again.

…Delete my card and then want to reactivate it?

You can add any cards you previously deleted as normal.

…Sell or upgrade my iOS device?

Before you sell your iOS device, you need to delete your card from Apple Pay to protect your financial information. You also should delete the Valley First mobile banking app from the phone. You may opt to contact Valley First to ensure that your card has been fully deleted from Apple Pay.

…Lend out my iOS device to someone?

We recommend you remove your card from Apple Pay before lending out your iOS device. Avoid lending your phone to anyone with whom you do not have a trusted relationship.

…Get a new debit or credit card?

If you get a new debit or credit card you must remove the previous card from Apple Pay and add the new card.

…Change the accounts linked to my card?

As long as you have not changed your default account for Interac Flash® purchases, changing the accounts linked to your card should have no impact on Apple Pay.

…Change my default account for Interac Flash® purchases?

If you change your default account for Interac Flash purchases, it will also become your default account for Apple Pay.

…Receive an error, “Card Not Added – Contact your issuer”, message while adding a card?

Your Valley First card is closed and therefore cannot be used.

Delete my card from an iPhone that is paired to an Apple Watch?

Your Valley First card will remain on the Apple Watch; they are treated as two separate tokens.

Unpair my Apple Watch?

Your Valley First card will be removed from the Apple Watch if it is unpaired.

How is Apple Pay secured?

Each Apple Pay transaction requires your authorization through Touch ID or a passcode. Your card number is not shared with the merchant or saved on your iOS device, instead using a secure token to complete the purchase.

What is NFC?

NFC stands for Near Field Communication, which is a contactless proximity technology. NFC uses the same technical standards as plastic cards (such as Interac Flash® or Mastercard PayPass), which allows you to tap your card to complete transactions. It is known for short range, secure transmission, with a maximum distance of less than 5-10 cm. In practice, phones need to be held very near to device readers for a few seconds to complete a transaction.

How do I know if a terminal accepts NFC?

![]() You will know that a terminal is capable of reading NFC if it has the label to the right, which looks a bit like the Wifi symbol. For Interac® Debit on Apple Pay you will also need to ensure that the reader has the correct software to accept Interac Flash®.

You will know that a terminal is capable of reading NFC if it has the label to the right, which looks a bit like the Wifi symbol. For Interac® Debit on Apple Pay you will also need to ensure that the reader has the correct software to accept Interac Flash®.

How does the technology work?

When you register a card with Apple Pay, the card is assigned a digital identification number, which is encrypted and verified by Apple and Interac and protects your payment information.

How am I protected against fraud?

Each Apple Pay transaction requires your authorization through Touch ID or a passcode. Your card number is not shared with the merchant or saved on your iOS device.

Introduction:

These Terms of Use govern your use of the Apple Pay service to make a payment with an eligible Credit Union debit card (“card”) on any Apple® device that supports the use of Apple Pay (“device”).

Please read these Terms of Use carefully. These Terms of Use are a legal agreement between you and us. If you add, activate or use your card for use of Apple Pay, it means that you accept and agree to these Terms of Use. In these Terms of Use, "you" and "your" means each Credit Union member who has been issued a Credit Union card. "We", "us", and "our" mean Credit Union.

Other Documents and Agreements:

These Terms of Use are in addition to, and supplement, all other agreements between Credit Union and Member regarding Credit Union’s products and services. If there is any conflict or inconsistency between these Terms of Use and the other agreements, then these Terms of Use will take priority and govern with respect to the Apple Pay service.

You understand that your use of Apple Pay will also be subject to agreements or terms of use with Apple Inc. and other third parties (such as your wireless carrier and the websites and services of other third parties integrated into Apple Pay).

Use of Cards in Apple Pay:

If you want to add a card to Apple Pay, you must follow the procedures adopted by Apple, any instructions provided by us, and any further procedures Apple or we adopt. You understand that we may not add a card to Apple Pay if we cannot verify the card, if your account is not in good standing, if we suspect that there may be fraud associated with your card or for any other reason we determine at our sole discretion. Apple Pay allows you to make purchases using your card wherever Apple Pay is accepted. Apple Pay may not be accepted at all places where your card is accepted.

Removal, Blocking, or Suspension of Card

We may not permit the addition of a card to Apple Pay, or we may remove, suspend or cancel your access to Apple Pay at any time, if we cannot verify the card, if we suspect that there may be fraud associated with the use of the card, if your account is not in good standing, if applicable laws change, or for any other reason we determine at our sole discretion.

You may suspend, delete or reactivate a card from Apple Pay by following Apple's procedures for suspension, deletion or reactivation. In certain circumstances, your card may be suspended or removed from Apple Pay by Apple.

Maximum Dollar Limit:

Payment networks, merchants or we may establish transaction limits from time to time in their or our discretion. As a result, you may be unable to use Apple Pay to complete a transaction that exceeds these limits.

Applicable Fees:

We do not charge you any fees for adding a card to Apple Pay. Please consult your card agreement for any applicable fees or other charges associated with your card.

Your mobile service carrier or provider, Apple or other third parties may charge you service fees in connection with your use of your device or Apple Pay.

Security:

You must contact us immediately if your card is lost or stolen, if your device is lost or stolen, or if your card account is compromised. If you get a new device, you must delete all your card and other personal information from your prior device.

You are required to contact us immediately if there are errors or if you suspect fraud with your card. We will resolve any potential error or fraudulent purchase in accordance with the applicable account agreement.

You agree to protect and keep confidential your Apple User ID, Apple passwords (including your fingerprint set up for Touch ID, if applicable). If you share these credentials with others, they may be able to access Apple Pay and make purchases with your card or obtain your personal information.

Before using Apple Pay you should ensure that only your credentials and fingerprints are registered on your device as these will then be considered authorized to make transactions related to your card. If the fingerprint or credentials of another person are used to unlock your device or make transactions, these transactions will be deemed to be authorized by you.

You are prohibited from using Apple Pay on a device that you know or have reason to believe has had its security or integrity compromised (e.g. where the device has been "rooted" or had its security mechanisms bypassed).

Apple is responsible for the security of information provided to Apple or stored in Apple Pay.

Liability for Loss:

You are solely responsible for all account transactions made using your card processed through Apple Pay. You are responsible for the completeness and accuracy of the account information you enter into Apple Pay. Only the individual member whose name is associated with the card should add the card to Apple Pay.

Privacy:

You consent to the collection, use and disclosure of your personal information from time to time as provided in our privacy policy, which is available on our website. We may share with or receive from Apple such information as may reasonably be necessary to determine your eligibility for, enrollment in and use of Apple Pay and any Apple Pay features you may select (for example, your name and details such as card number and expiry date).

Apple may aggregate your information or make it anonymous for the purposes set out in its privacy policy or terms of use. To help protect you and us from error and criminal activities, we and Apple may share information reasonably required for such purposes as fraud detection and prevention (for example, informing Apple if you notify us of a lost or stolen device).

Communications:

You agree to receive communications from us, including emails to the email address or text message to the mobile number you have provided in connection with your card account. These communications will relate to your use of your card(s) in Apple Pay. You agree to update your contact information when it changes by contacting us. You may also contact us if you wish to withdraw your consent to receive these communications, but doing so may result in your inability to continue to use your card(s) in Apple Pay.

No Warranty and Exclusion of Liability:

For the purpose of this Section, “Credit Union” means Credit Union and its agents, contractors, and service providers, and each of their respective subsidiaries. The provisions set out in this section shall survive termination of these Terms of Use.

Apple Pay service is provided by Apple, and Credit Union is not responsible for its use or function. You acknowledge and agree that Credit Union makes no representations, warranties or conditions relating to Apple Pay of any kind, and in particular, Credit Union does not warrant: (a) the operability or functionality of Apple Pay or that Apple Pay will be available to complete a transaction; (b) that any particular merchant will be a participating merchant at which Apple Pay is available; (c) that Apple Pay will meet your requirements or that the operation of Apple Pay will be uninterrupted or error-free; and (d) the availability or operability of the wireless networks of any device.

Credit Union will have no liability whatever in relation to Apple Pay, including without limitation in relation to the sale, distribution or use thereof, or the performance or non-performance of Apple Pay, or any loss, injury or inconvenience you suffer. You may want to consider keeping your physical card with you to use in the event you cannot make Apple Pay transactions.

Changes to the Terms of Use:

We may change these Terms of Use or the agreements associated with the use of your card with Apple Pay. You agree to any changes to these Terms of Use or agreement(s) associated with the use of your card or account by your continued use of your card with Apple Pay. If you do not accept the revised Terms of Use or agreement(s), you must delete your card from Apple Pay.

Contacting Us:

You may contact us about anything concerning your card or these Terms of Use by calling the phone number found on our website.

If you have any questions or complaints about, or disputes with, Apple Pay, you should contact Apple.

Apple, the Apple logo, Apple Pay, Apple Watch, iPad, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. iPad Pro is a trademark of Apple Inc. All other trademarks are the property of their respective owner(s).

Interac Flash® and Interac® Debit are trademarks of Interac Inc. Used under licence.

The Contactless Symbol is a trademark owned by and used with permission of EMVCo, LLC.

Everything is easier with a little help.

We acknowledge that we have the privilege of doing business on the traditional and unceded territory of First Nations communities.

© First West Credit Union. All rights reserved.