REFERRAL PERKS®

Earn $100* for you and your friend for every successful referral.

Learn how an FHSA helps you save for a mortgage faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

Whether it’s to start a home renovation, consolidate your debt, or pay for unexpected expenses, borrowing money can be a useful tool to reach your goals. While borrowing does come with costs, knowing what to expect can go a long way towards improving your overall financial well-being.

To help you navigate this, we've created a comprehensive guide that covers what you need to know about borrowing money to meet your financial goals — along with practical tips to help you make decisions about your money.

Before we explore the different types of loans available, let’s go over some fundamental aspects of borrowing. The ‘cost of borrowing’ refers to the original amount that you borrowed, plus interest and any applicable fees you’re required to pay.

Now, let’s take a closer look at some key terms for a deeper understanding of the cost of borrowing.

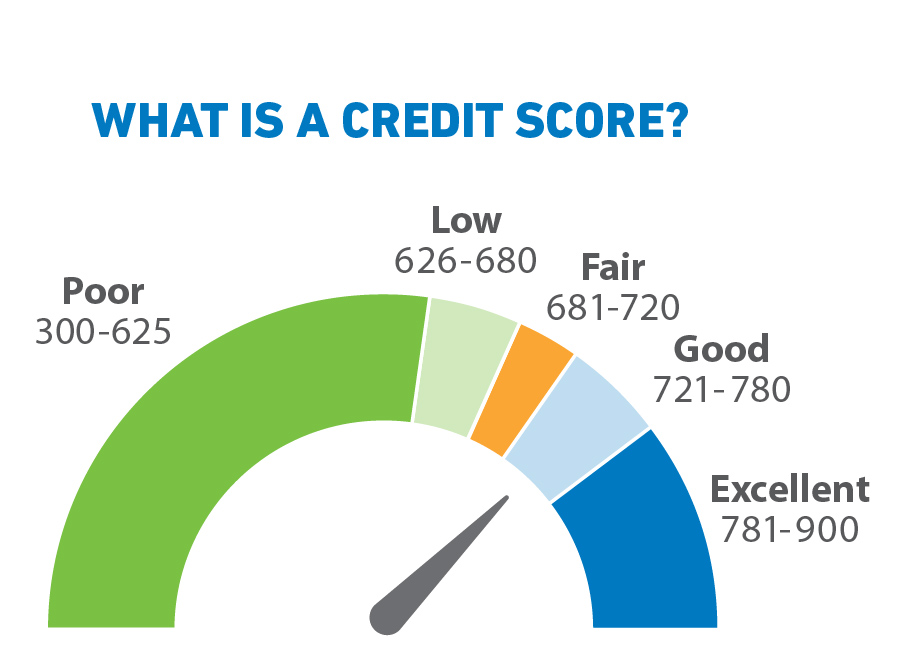

Your credit score is a reflection of your borrowing behaviours distilled into a triple digit number. This number tells lenders how trustworthy of a borrower you are, and can impact the rates you qualify for on your mortgage, personal loans, and more. Typically, the higher your credit score, the lower the borrowing costs. Actions such as paying bills on time, only borrowing what you need, and infrequently applying for credit can help you maintain a stronger credit score.

Regularly checking your credit scores will help you catch errors quicker and stay eligible for better rates. You can request a copy from one of the two major credit bureaus in Canada: Equifax and TransUnion.

Your credit score is a three-digit number, ranging from 300 to 900, that lenders use to evaluate your eligibility for loans and determine what interest rate they’ll offer.

Learn more about the best ways to improve your credit score.

As mentioned earlier, establishing yourself as a responsible borrower comes with several perks. Here are just a few key ones:

There isn’t one single way to borrow money. Knowing the different types of loans available can help you choose the option that best fits your unique financial goals and needs.

For smaller purchases, credit cards help maintain healthy credit while paying for daily expenses. Many issue rewards or cash back on what you spend, but they carry higher interest rates that add up fast.

Best used for: Everyday purchases you plan on paying off within the month.

If you're planning on making a bigger purchase, personal loans come with fixed interest rates and structured repayment terms, which make budgeting more predictable compared to credit cards.

Best used for: Long-term investments, or consolidating debt.

If the unexpected happens, lines of credit offer flexibility by allowing you to borrow funds as needed, up to a set limit. They typically have lower interest rates compared to credit cards.

Best used for: Emergency funding for unexpected expenses.

Automatic payments are a great way to ensure you stay on track with repaying what you borrowed.

Talk to an advisor about your goals, and which borrowing options would help you the most. This conversation should cover term lengths, interest rates, and how they can help you secure the best one for your situation.

Take advantage of online loan calculators to estimate total costs, monthly payments, and to plan your borrowing strategy effectively.

When it comes to borrowing, your credit score matters. Ignoring it could mean higher interest rates or even rejected applications but nurturing it could mean better terms and interest rates.

Get the financial advice you need

You don't have to figure out a plan on your own. Work with an advisor to find solutions that support your financial goals.

We acknowledge that we have the privilege of doing business on the traditional and unceded territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian