REFERRAL PERKS®

Earn $100* for you and your friend for every successful referral.

Learn how an FHSA helps you save for a mortgage faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

When you start your search to buy a home you are going to hear a lot about mortgage rates. You’ll either hear about how they are going up, that it’s great that they are going down, or possibly, why extremely low rates aren’t always a good thing.

When you buy a home, the down payment you have been saving up for is only part of the equation. The interest rate affects your monthly payments. It also affects the total amount you will pay for your property over time. The purchase price is what your loan is based on, but the higher the interest rate, the more you will end up paying in the long run.

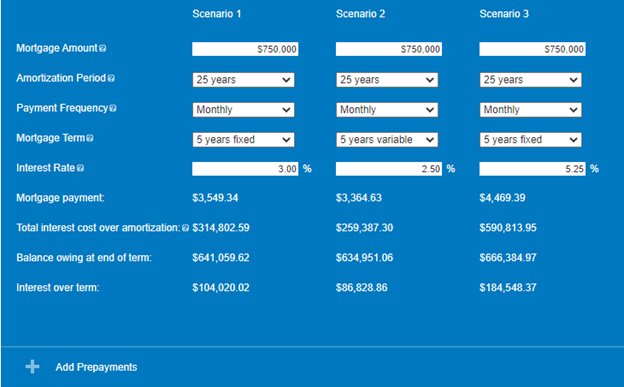

It’s important to understand your interest rate, whether the rate is fixed or variable. Even 0.50% can make a huge difference in the amount that you pay over your entire mortgage.

So, what's the difference?

This means that the interest rate remains the same over the agreed upon borrowing period, typically a 5-year term. But if you want to lock in a great rate you can also get up to a 10-year term.

|

Locks in your monthly payments and you don’t have to worry about economic shifts that might increase your rate. |

|

|

If interest rates drop considerably, you may miss out on some potential savings. |

|

If you want a set-it and forget it mortgage, then this is the rate for you. The principal amount you're repaying won't change if our prime rate changes.

With a variable rate mortgage, the interest rate that you pay will change as our prime lending rate changes. Your mortgage payments will remain the same but the amount that is paid towards the principal of your mortgage will vary.

|

If the Bank of Canada rates trend downward, then interest rates automatically decline as well. |

|

|

If rates rise significantly, your financial burden might become more than you can handle. |

|

Choosing a variable rate in the short-term hoping to predict a rate drop so you can lock in at the right time could be a risky business. Rates can be hard to predict.

TIP: Did you know that all home buyers, first purchase or not, must pass a stress test? This is to show your finances can handle any possible interest rate increases. For this test, the minimum qualifying rate is set by the government. That rate is currently 5.25%, or your interest rate plus 2%, whichever is higher. Please note that this rate is subject to change without notice.

*This example is for illustrative purposes and is not intended to provide investment advice. The applicability and accuracy of the calculations are not guaranteed. See our mortgage rates.

To find out exactly how big of a difference interest rates can make for you, use our mortgage calculator, or for an even better idea of how a mortgage can work for your specific needs, contact an advisor today.

If the time is right for you to buy a new house, apply for a mortgage online today to lock in your rate with our 120-day rate guarantee.

Everything is easier with a little help.

We acknowledge that we have the privilege of doing business on the traditional and unceded territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian